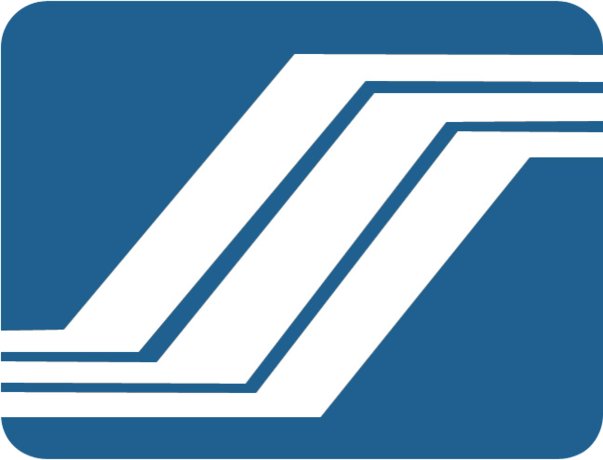

SSS Loan Complete Guide: What you need to know

The Philippines Social Security System (SSS) has many loan choices for its members, like salary loans.

If you’re wondering “SSS how to loan,” this comprehensive guide will walk you through the entire process. From the initial application to the repayment terms, we will cover everything you need to know to secure an SSS loan.

By following the steps outlined in this guide and ensuring that all requirements are met, you can efficiently apply for an SSS loan and receive the financial assistance you need. Let’s delve into the different types of SSS loans and the details involved in each one.

Key Takeaways

- File for an SSS loan by completing the Member Loan Application form.

- Submit applications online through My.SSS or at a local SSS branch.

- OFWs can file through SSS Foreign Representative Offices or authorized representatives.

- Ensure employers maintain updated Specimen Signature Cards to avoid delays.

- Understanding the SSS loan guide can help in meeting the necessary requirements with ease.

Introduction to SSS Loans

The Social Security System (SSS) offers loans like the salary loan, housing loan, and business loan. These loans are designed to help members in different financial situations. It’s important to know about these loans, how to apply, and the requirements.

These loans usually have to be paid back in two years through 24 monthly payments. The interest is 10% a year and decreases as you pay off the principal. Also, if you miss a payment, there’s a 1% monthly penalty. A 1% fee of the borrowed amount is taken out upfront.

Employers are key to get started with SSS how to loan process because they handle the repayment through payroll deductions. If you change jobs, the new employer must continue the deductions. This ensures your loan is paid on time.

If a loan is not paid, the outstanding amounts will be taken from any benefits the member might claim later. This includes retirement or benefits due to disability or death. If you’ve paid too much on a previous loan, it can either go towards a new loan or be refunded if you ask.

The SSS Conso Loan Program, started on October 4, 2022, lets members with unpaid loans combine them. This program also removes penalties after full repayment. You can choose payment terms up to 60 months, based on how much you owe. To be eligible, you need an active My.SSS account and no pending retirement benefits.

Knowing about these loans and how they work can help members manage their finances better. It’s a good way to use the services offered by SSS.

Eligibility Criteria for SSS Loans

It’s important to know the SSS loan eligibility criteria if you’re thinking about an SSS Salary Loan. These criteria make sure applicants fit certain standards before getting a loan. Let’s look at what employed members need, including their contributions.

1. Employed Members

To get an SSS Salary Loan, employed members have requirements to meet. They need to be active in paying SSS contributions. Also, they can’t have claimed a final benefit like permanent disability, retirement, or death benefit. Applicants must be under 65 years old and cannot have been disqualified for fraud before.

2. Contribution Requirements

The SSS Salary Loan has clear rules about contributions. For a one-month loan, you need at least 36 monthly contributions. Six of these must be within the last 12 months before you apply. For a two-month loan, you need 72 monthly contributions. Keeping up with SSS contributions is key to staying eligible.

- 36 monthly contributions for a one-month loan

- 72 monthly contributions for a two-month loan

- Six contributions within the last 12 months

- Must be under the age of 65 at the time of application

- No final benefit (e.g., permanent disability, retirement, death)

Meeting the SSS loan eligibility criteria helps employed members get financial help when they need it. It ensures they can take care of personal or family needs easily.

SSS Loan Requirements

To apply for an SSS loan, you must have the right documents. This includes documents specific to the loan and valid IDs. Having these ready speeds up the approval.

1. General Documentation

- Completed Member Loan Application form

- SSS digitized ID or E-6 form (Acknowledgement Stub) with a recent photo

- Any two valid IDs, one with a recent photo

Before you go to an SSS branch or use the My.SSS website, gather these loan documents. If someone else will submit your documents, they also need to bring a Letter of Authority (LOA) and your SSS card.

2. Valid Forms of Identification

When you submit your loan documents, make sure to include valid identification. This will help avoid any delays. Some valid IDs are:

- Unexpired driver’s license

- Passport

- Voter’s ID

- Other government-issued IDs

What SSS Loans are Available to You

The Social Security System (SSS) in the Philippines offers various loan programs to assist its members in addressing their financial needs. These loans are designed to provide support in different circumstances, whether for personal expenses, coping with natural disasters, housing needs, or educational purposes. Understanding the eligibility requirements, loan amounts, and repayment terms of these loans can help members make informed decisions and maximize the benefits available to them.

Below is a detailed table that outlines the key features of the different types of SSS loans, providing a comprehensive overview for members seeking financial assistance.

| Loan Type | Purpose | Eligibility | Loan Amount | Repayment Terms |

| Salary Loan | To provide financial assistance to members for personal needs. | Members must have at least 36 posted monthly contributions, with six contributions in the last 12 months before the application. | Up to twice the average of the member’s last 12 monthly salary credits (MSC). | Payable in 24 monthly installments with an interest rate of 10% per annum. |

| Calamity Loan | To assist members affected by natural disasters. | Members residing in areas declared under a state of calamity and have at least 36 monthly contributions. | Equivalent to one-month salary credit or the amount the member is eligible for based on their contributions. | Payable in 24 monthly installments with an interest rate of 10% per annum. |

| Housing Loan | To help members purchase, construct, or renovate a house. | Members must have at least 24 monthly contributions and be under 60 years old at the time of application. | Depends on the member’s capacity to pay and the appraised value of the property. | Payable in up to 30 years with varying interest rates based on the loan amount and repayment period. |

| Educational Loan | To provide financial support for members or their beneficiaries’ educational needs. | Members must have at least 36 monthly contributions. | Maximum of PHP 20,000 per semester or trimester. | Payable in up to five years with a grace period corresponding to the length of the course. |

How to Apply for SSS Loan

Getting an SSS loan is made easy to help all members. You can apply in person or online, whichever suits you best. As for Overseas Filipino workers (OFWs), they can apply at SSS Foreign offices or through someone in the Philippines.

Note that Employers are key to the loan process too. They need to keep their Specimen Signature Cards updated. This makes applying for loans smoother for workers.

Here’s a guide on SSS how to loan for both methods.

In-person Application

Prefer to do things face-to-face? Applying at an SSS branch is simple. Just bring your loan application and the needed papers with you.

- Documentation: Carry your SS card and two IDs that are signed. One should have your picture. OFWs can have someone else apply for them.

- Employer Certification: If you work for someone, your boss needs to okay your loan. They’ll handle any loan deductions if you leave the job.

- Processing Time: Usually, it takes 3-5 working days to get your SSS salary loan approved.

Online Application

Like to do things online? The SSS loan online application is handy. Use the My.SSS portal for a smooth application process.

SSS How to Loan: Online Application Process

Applying for an SSS loan is made simple and easy. By using an SSS online account, members can click through to E-Services to start their loan application. This guide will walk you through how to apply step by step.

Before you start, make sure your My.SSS account info is current. The amount you can borrow is shown based on your paid contributions. For a one-month salary loan, if you’ve made 36 monthly payments, you can get up to Php 25,000. With 72 monthly payments, you could qualify for a two-month loan of Php 50,000.

Here’s how to apply:

- Log in to your My.SSS portal. Sign in on the SSS website. If you’re new, you’ll need to make an account

- Go to the E-Services and click ‘Apply for Salary Loan’.

- Fill out the loan form carefully with accurate information. Fill in your details carefully on the online form to avoid delays.

- Submit and Track. After applying, your employer will need to confirm it. You can check your loan status on My.SSS.

- Choose how you want your loan sent by using the DAEM. You can pick a bank or an e-wallet. (PESONet banks, e-wallet/RTC/CPO, or SSS UBP Quick Card).

- Send in your application and make sure to submit any supporting documents. Upload required documents, like IDs, depending on your chosen disbursement method during DAEM enrollment.

Once you’ve enrolled your disbursement account, your branch will need 1 to 2 days to approve it.

Here’s a table that compares the SSS loan form versions:

| Version | Votes |

|---|---|

| 2015 | 95 |

| 2013 | 242 |

| 2012 | 27 |

| 2006 | 55 |

By making the SSS loan process easier, more members can quickly get the money they need. In just 2019, 29.98 billion in loans were given out to 1.46 million members. This shows how streamlined systems help members get their loans fast.

Understanding SSS Loan Terms and Conditions

Understanding the terms and conditions of an SSS loan is key for anyone considering one. It ensures the lending and process on how to loan from SSS is clear and fair for workers, whether they’re employed, self-employed, or voluntary members of SSS.

Interest Rates and Payment Terms

The SSS loan interest rate is fixed at 10% per year. It’s calculated on a diminishing balance, which means you pay interest only on the amount you still owe. This setup reduces your interest costs over the loan’s life. The loan must be paid within two years through 24 monthly payments. Knowing how the SSS loan interest rate works helps you plan and avoid extra costs.

Loans can be renewed after paying off half the original amount, as long as you’re also halfway through the term. If payments are late, a 1% monthly penalty is charged on the overdue amount until full repayment.

Service Fee

A 1% service fee is taken from your loan upfront. This covers the loan’s administrative costs. Keep this fee in mind when figuring out your take-home loan amount. Knowing about the service fee helps you plan your finances better.

Here’s a quick look at the key SSS loan terms:

| Term | Details |

|---|---|

| Interest Rate | 10% per annum, diminishing principal balance |

| Payment Period | 24 months or 2 years |

| Service Fee | 1% of loan amount |

| Late Payment Penalty | 1% per month |

| Renewal Condition | 50% principal paid, 50% term lapsed |

Disbursement and Repayment of SSS Loans

The Social Security System (SSS) makes it easy for members to get and pay back loans. It’s important to know how this works for a SSS how to loan process. Let’s look at how SSS sends out loans and the way they get paid back.

Disbursement Channels

After an SSS loan is approved, the money goes straight into the bank account you listed on the Disbursement Account Enrollment Module (DAEM). Overseas Filipino workers (OFWs) can manage their loan applications at SSS Foreign Representative Offices or through someone in the Philippines they trust. Employers can also apply for loans for their workers if they keep their SSS web account current and update their Specimen Signature Card every year.

Digital wallets like GCash, PayMaya, Coins.ph through DCPay, and CBP Cash Padala through MLhuillier are other ways to get your loan.

For DAEM, you need proof of your account, a valid ID, and a selfie with both. If you choose “Bank”, you can show an ATM card, passbook, bank certificate, receipt of foreign remittance, a screenshot of your online banking account, or a validated deposit slip as proof.

Repayment Process

Repaying an SSS loan is easy and flexible. You have two years to pay it back in 24 monthly installments. If you have a job, your employer deducts your loan payments from your salary and sends them to the SSS. If you pay on your own, you can use payment centers like Bayad Center.

You start paying back the loan the second month after you get the money. The loan’s interest rate is 10% a year, and it goes down as you pay off the principal. If you miss a payment, you’ll pay a 1% monthly penalty until it’s fully paid. Any extra money you pay goes straight to the principal amount you owe.

You can ask for a new loan after paying back half of the initial loan and when half of the payment period is over. The amount you can borrow again is the approved amount minus any unpaid short-term loan balances.

| Disbursement Channel | Description |

|---|---|

| Bank Account | Funds disbursed directly to registered bank accounts. |

| Digital Wallets | GCash, PayMaya, Coins.ph via DCPay, CBP Cash Padala via MLhuillier. |

| Employers | Employers file and manage loan applications on behalf of employees. |

| Overseas | SSS Foreign Representative Offices or relatives in the Philippines. |

Common Issues in SSS Loan Applications

Applying for an SSS loan can sometimes feel easy. Yet, many applicants run into common problems in the simple SSS how to loan process. Understanding these issues can save a lot of time and avoid headaches.

- One main problem is discrepancies in member data. If your personal info doesn’t match across all documents, you could face delays or denials. It’s crucial to keep your information consistent and updated.

- Not meeting the requirements for contributions or eligibility is another issue. You need at least thirty-six (36) monthly contributions for a one-month salary loan. For a two-month salary loan, seventy-two (72) contributions are needed. Also, six (6) of these contributions should be within the last twelve (12) months.

- Issues with employer certifications come up too. The employer must handle amortization through payroll. Any mistakes here can impact your loan approval. Working with your HR department closely can help avoid these errors.

- Understanding the SSS loan’s terms and conditions is also key. For example, the salary loan has an interest rate of 10% per annum. Knowing this helps you prepare for the loan’s financial side and avoid problems.

Below is a table with the key SSS loan requirements and terms. It helps identify what could go wrong:

| Criteria | Details |

|---|---|

| Minimum Contributions for One-Month Loan | 36 posted monthly contributions |

| Minimum Contributions for Two-Month Loan | 72 posted monthly contributions |

| Recent Contributions Requirement | 6 contributions within the last 12 months |

| Loan Interest Rate | 10% per annum on diminishing principal balance |

| Service Fee | 1% of the loan amount (deducted upon approval) |

| Loan Approval Time | 3-5 working days |

| Disbursement Channels | Bank Account, GCash, PayMaya, Coins.ph, CBP Cash Padala via MLhuillier |

| Eligibility for Loan Renewal | At least 50% of the principal paid and term elapsed |

Effectively troubleshooting SSS loan applications means being proactive. Pay attention to all requirements and keep your data accurate. This approach can make getting your loan much smoother.

Alternative Funding Options

If you’re having trouble with SSS loans or need more money, many other choices exist. You can try personal loans from banks or find government loans from places like Pag-IBIG or cooperative funds.

Personal Loans

For small business owners, personal loans are a good option instead of SSS loans. They’re often easier to get and more flexible. Banks let you pay back the money over 6 to 48 months, sometimes even 60 months for long-term customers. And companies like First Circle can approve loans in just 24 hours.

- Invoice Financing: This helps businesses turn invoices into quick cash. It’s great for keeping cash flow steady and covering regular bills.

- Purchase Order Financing: It provides funds based on client orders. This helps businesses handle more orders than their current cash allows.

- Short-term Online Loans: These need to be paid back in 3 to 6 months. But, they have higher interest rates than bank loans.

Other Government Loans

There are more government loan options in the Philippines, not just SSS loans. Pag-IBIG and cooperative funds offer them. These options help various sectors like Agri-Business, Manufacturing, and Tourism. For example, Pag-IBIG has loans for housing, making a living, and disaster help.

| Loan Type | Provider | Key Features |

|---|---|---|

| Pag-IBIG Housing Loan | Pag-IBIG Fund | Long-term, low-interest rates |

| Cooperative Loans | Various Cooperatives | Community-based, flexible terms |

| DPWH Infrastructure Loan | DPWH | Focused on construction and infrastructure projects |

Looking into alternative SSS funding, like personal or government loans, can help. They offer financial aid tailored to your needs. Checking these options can boost the financial health and growth of your business or project.

Renewing Your SSS Loan

Renewing your SSS loans is pretty simple if you follow a few rules. You need to have paid back at least 50% of your first loan. Also, you should have made six payments in the past year.

To renew for a one-month salary loan, you must have 36 monthly payments. Six of those should be in the last year. For a two-month loan, you need 72 payments, with six in the last year.

The loan must be paid back in two years. When you renew, they subtract any old loan balance from the new one. The interest is 10% a year, and a 1% service fee is taken from the loan amount.

- 36 posted monthly contributions for a one-month loan

- 72 posted monthly contributions for a two-month loan

- Loan term: 24 equal monthly payments

- Interest rate: 10% per annum

Employers have a big role when it comes to renewing SSS loans. They deduct the payments from your salary and send them to SSS. It’s important to tell SSS if you switch jobs or your contact details change.

“Any arrearages, unpaid loans, and associated penalties can be deducted from the benefits being claimed by the member-borrower.”

| Loan Type | Contributions Required | Interest Rate | Payment Terms |

|---|---|---|---|

| One-Month Salary Loan | 36 Contributions | 10% Per Annum | 24 Equal Monthly Payments |

| Two-Month Salary Loan | 72 Contributions | 10% Per Annum | 24 Equal Monthly Payments |

Stick to the SSS loan policy to renew without a hitch. This way, you get the financial help you need without falling into debt.

Customer Support and Contact Information

Understanding how to use the Social Security System (SSS) services is vital. There are many ways to get help quickly and well. For more questions on contributions, SSS how to loan updates, or other services, SSS has you covered.

Contacting SSS

To get help fast, use the SSS contact information. The SSS Customer Support Center is open from 7:00 AM to 10:00 PM, Monday to Friday.

- SSS Hotline: 8-1455 (landline), 02-1455 (mobile).

- SSS Call Center: (632) 7917-777.

- SSS Toll-Free Number: (632) 8920-6401.

- Text SSS: Send “SSS” to 2600 (charges apply).

Overseas Filipino Workers (OFWs) have their own toll-free numbers:

| Region | Contact Number |

|---|---|

| Hong Kong, Singapore | 001-800-0025-5777 |

| Malaysia, Taiwan | 00-800-0225-5777 |

| Qatar | 00800-100-260 |

| United Arab Emirates | 800-0630-0038 |

| Saudi Arabia | 800-863-0022 |

| Bahrain | 8000-6094 |

You can also email SSS at these addresses:

- member_relations@sss.gov.ph

- onlineserviceassistance@sss.gov.ph

- PRNHelpline@sss.gov.ph

Be careful of scammers. Always check you’re using official SSS channels before sharing personal info.

Additional Resources

SSS has more ways to help you:

- For tasks like checking contributions and loans, visit the SSS website.

- Use the uSSSap Tayo portal for easier inquiries.

- Check Facebook and Twitter for updates and help from SSS.

- Download the SSS mobile app on Android and Apple for more tools.

With all these SSS contact information options, managing your inquiries is easier and secure. Use these resources for a better SSS experience.

Conclusion

The SSS Loan programs in the Philippines offer financial help when you need it most. This includes help for salary gaps or school fees. Knowing the eligibility criteria and terms is key to borrowing wisely. With a need for 36 monthly contributions, a 10% interest rate per year, and a small service fee, the SSS Salary Loan is made to be easy to get.

The new Consolidated Loan Program and the fast online application process have improved things a lot in the SSS how to loan setting. Now, applying through the SSS Mobile App or online is quick and simple. This has made it much easier for members to keep up with their loans.

To wrap up, understanding the different SSS loans, like educational loans or the penalty forgiveness program, is crucial. These programs are here to assist members with overdue loans. With these insights, members can make better choices and improve their financial health significantly.

FAQ

What types of loans does the SSS offer to members?

The SSS provides various loans. These include salary, housing, and business loans for members.

What are the eligibility criteria to apply for an SSS loan?

To get a one-month loan, you need 36 contributions, with six in the last twelve months. For two months, you need 72.

How can I apply for an SSS loan?

Apply at an SSS branch or online via My.SSS portal. OFWs can apply at SSS Foreign Offices or through a rep in the Philippines.

What documents are required for an SSS loan application?

You need a loan form, SSS digitized ID or E-6, and two valid IDs. One must have a recent photo. Authorized reps may need extra documents.

What is the interest rate for an SSS salary loan?

The annual interest rate is 10%. It’s calculated on the remaining balance.

How will I receive the disbursement of my SSS loan?

Loans are paid via direct deposit to your bank account.

What is the repayment process for an SSS loan?

Employed members have deductions from their salary. Voluntary members pay directly to SSS or through Bayad Center. It’s paid over 24 months.

What are common issues that may arise in the SSS loan application process?

Problems include member data errors, not meeting requirements, and issues with employer certifications. These can delay or deny loan approval.

Are there alternative funding options if my SSS loan application is not approved?

Yes, you can get personal loans from banks or other institutions. You can also look into government loans from Pag-IBIG or cooperatives.

How can I renew my SSS loan?

To renew, pay off half of your original loan and have six months’ contributions in the last year. Any old loan balance will be subtracted from the new loan.

How can I contact SSS for support or additional information?

Contact SSS via hotline (1455), email (member_relations@sss.gov.ph), or the uSSSap Tayo portal. OFWs have toll-free numbers. Check the SSS website for more info.

English

English